The Promise and Pitfalls of Tokenization in Digital Finance

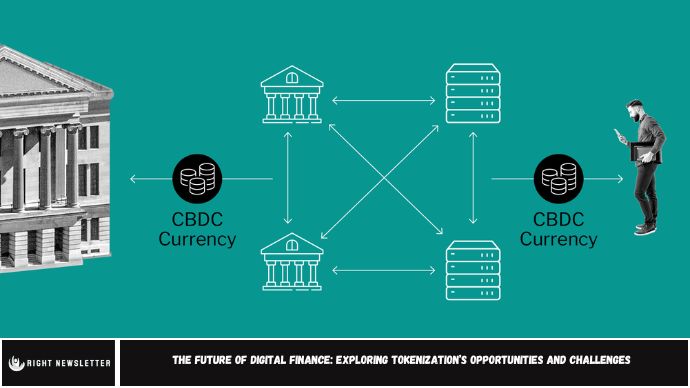

Tokenization is the process of converting an asset’s rights into a digital token on a blockchain or distributed ledger technology (DLT). Unlike traditional systems, blockchain operates on distinct principles, enabling the use of smart contracts that automatically execute when predefined conditions are met. These smart contracts are vital in the blockchain ecosystem, allowing for efficient data access, validation, and updates with high accuracy and security.

In the world of securities and investment funds, tokenization involves creating digital versions of assets like equities, bonds, or fund units, which can then be traded seamlessly on blockchain platforms.

The key motivations behind tokenization are to increase liquidity, enhance transparency, reduce costs, and offer broader access to investment opportunities. Tokenization makes fractional ownership possible, enabling a more diverse group of investors to participate in high-value assets. Tokenized assets can be divided into two primary categories:

- Financial Assets: Such as bonds, stocks, funds, and other securities.

- Non-Financial Assets: Like real estate and other physical assets, also referred to as Real World Assets (RWAs).

By tokenizing these assets, the financial ecosystem becomes more inclusive, efficient, and accessible, creating new opportunities for issuers and investors alike.

The Opportunities of Tokenization in Digital Finance

Tokenization is not just a buzzword; it has the potential to reshape the way financial assets are managed, traded, and interacted with. Below, we’ll examine the key opportunities tokenization offers.

1. Increased Liquidity in Traditionally Illiquid Assets

Traditional financial markets often struggle with assets that are difficult to trade, such as real estate or fine art. Tokenization allows these assets to be represented as digital tokens, which can be easily bought, sold, or traded on blockchain platforms. This increases liquidity, making previously illiquid assets more accessible to a global pool of investors.

2. Reduced Transaction Costs and Increased Efficiency

One of the major advantages of tokenization is the ability to reduce transaction costs. Blockchain technology can streamline processes by eliminating intermediaries like banks, brokers, and notaries, enabling direct peer-to-peer transactions. This can make the entire financial ecosystem more efficient, faster, and cost-effective.

3. Global Access to Investments

Tokenization breaks down geographical barriers by allowing global access to investment opportunities. Assets can be fractionalized into smaller tokens, enabling individuals to invest in markets that would otherwise be inaccessible to them. This democratizes access to various asset classes, from real estate to collectibles.

4. Improved Security and Transparency

Blockchain’s immutable ledger makes tokenized assets highly secure and transparent. Every transaction is recorded, providing a clear, tamper-proof history. This increases trust in the financial system and reduces the risk of fraud.

The Challenges of Tokenization in Digital Finance

While tokenization presents immense opportunities, it also comes with several challenges that need to be addressed to ensure its long-term success.

1. Regulatory Uncertainty

The biggest hurdle facing tokenization is regulatory uncertainty. Financial authorities around the world are still grappling with how to regulate tokenized assets, which can create confusion and reluctance among investors and businesses. Inconsistent regulations across different jurisdictions can slow adoption.

2. Technical Barriers

Although blockchain technology has evolved significantly, there are still technical challenges associated with tokenization, such as scalability issues, high energy consumption, and interoperability between different blockchain networks. These issues must be addressed to make tokenization viable for mainstream adoption.

3. Market Volatility

The volatility of cryptocurrency markets can affect the value of tokenized assets. As many tokenized assets are linked to cryptocurrencies, fluctuations in the value of tokens may create risks for investors. Stablecoins and other mechanisms are being explored, but volatility remains a concern.

4. Adoption by Traditional Financial Institutions

Despite its potential, tokenization has not yet been widely adopted by traditional financial institutions. Many banks and financial organizations remain cautious, given the lack of established frameworks, regulatory clarity, and the complexity of integrating tokenization into existing systems.

Tokenization in Real-World Applications

To better understand the scope of tokenization, let’s take a closer look at some industries where it is already making an impact:

Real Estate

In real estate, tokenization allows investors to own fractional shares of properties, lowering the entry barriers to property investment. Platforms like RealT are offering tokenized real estate investments, democratizing access to property ownership.

Art and Collectibles

Fine art and collectibles are traditionally illiquid markets. With tokenization, fractional ownership of high-value items such as paintings, antiques, and rare items becomes possible, opening up opportunities for smaller investors to participate.

Supply Chain Management

Tokenization can also improve supply chain transparency. By creating digital tokens that represent goods and products, companies can track assets from production to delivery, ensuring transparency, reducing fraud, and improving efficiency.

The Future of Tokenization in Digital Finance

The future of tokenization holds enormous potential, but its widespread adoption will depend on overcoming current challenges. Continued innovation in blockchain technology, clearer regulatory frameworks, and increased trust from traditional financial institutions will be key to unlocking tokenization’s full potential.

Conclusion

Tokenization is poised to transform digital finance, offering new opportunities for investment, increased transparency, and reduced transaction costs. However, its success will depend on resolving regulatory, technical, and market-related challenges. As the world becomes increasingly digital, tokenization could play a crucial role in the evolution of finance, but only time will tell how it fully integrates into the global financial system.

FAQs

What is tokenization in digital finance?

Tokenization involves converting assets into digital tokens on a blockchain, making them tradable, fractionalized, and secure.

How does tokenization increase liquidity?

Tokenization allows traditionally illiquid assets to be divided into smaller parts, making it easier to buy, sell, or trade them.

What are the benefits of tokenizing assets?

Benefits include lower transaction costs, enhanced transparency, global access to investments, and increased efficiency in financial transactions.

What challenges does tokenization face?

Challenges include regulatory uncertainty, technical barriers, market volatility, and slow adoption by traditional financial institutions.

How is tokenization used in real estate?

Tokenization allows fractional ownership of real estate properties, enabling smaller investors to participate in the market.

What is the future of tokenization in finance?

Tokenization will likely grow in importance as blockchain technology advances and regulatory frameworks evolve, transforming how financial assets are managed and traded.